Comparative Study of Property Tax Rates Across U.S. States

Understanding Property Tax: What It Is and Why It Matters

Property tax is a levy imposed by governments on real estate, calculated based on the property's assessed value. It plays a crucial role in funding public services like schools, roads, and emergency services. Understanding how property tax rates work helps homeowners and investors make informed decisions.

Property taxes are a necessary evil; they fund the very services that make our communities livable.

The rates can vary significantly from one state to another, affecting how much residents pay and how local governments generate revenue. For instance, a homeowner in New Jersey may face a much higher property tax rate compared to someone in Texas, impacting their overall financial situation.

Moreover, property tax can influence housing market dynamics, as higher rates may deter potential buyers. This can lead to a ripple effect, shaping community development and local economies in various ways.

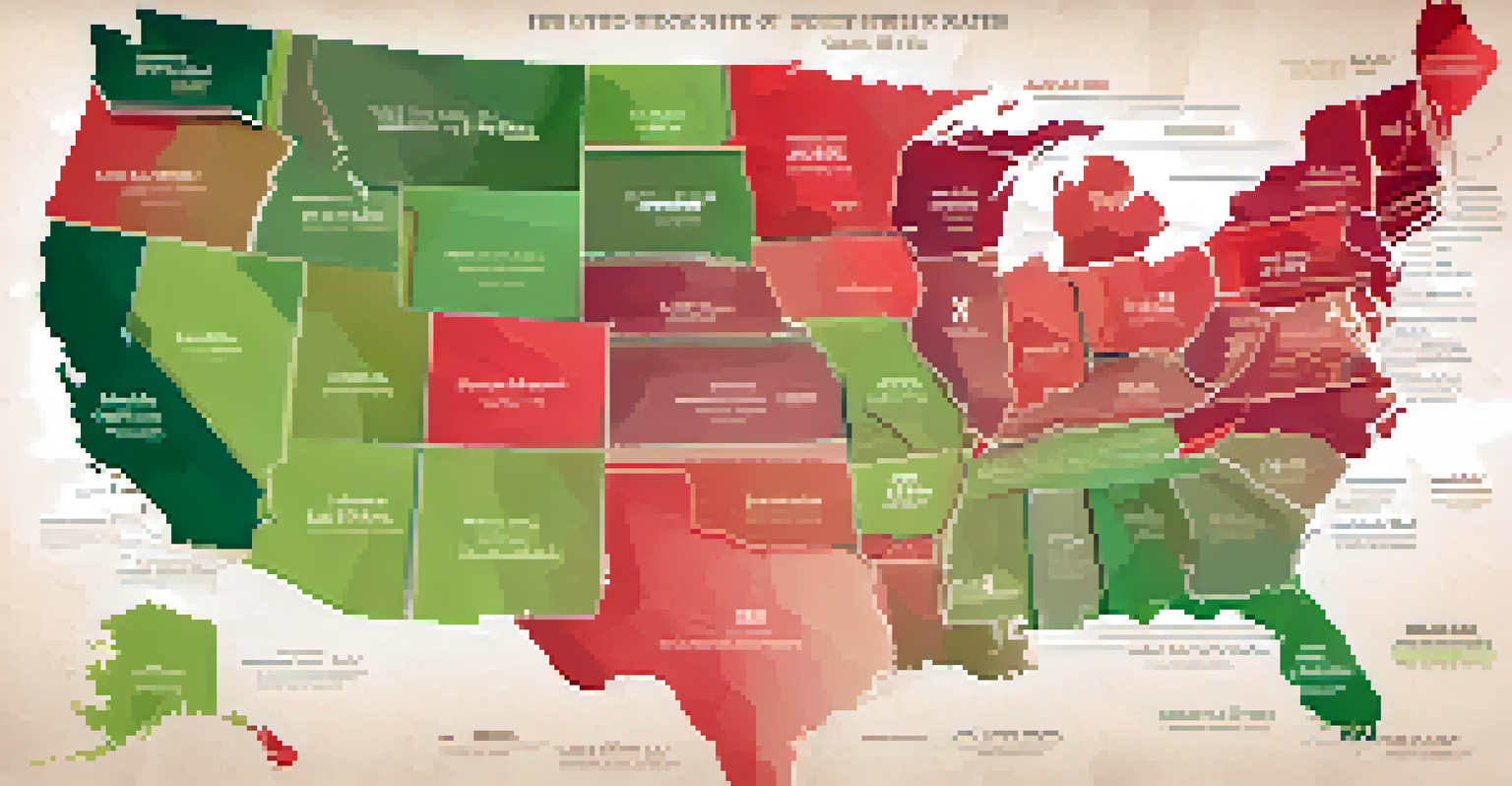

A Snapshot of Property Tax Rates Across the U.S.

As of 2023, property tax rates across the United States display a wide range of averages, with some states like New Jersey and Illinois consistently ranking among the highest. These states often rely heavily on property taxes to fund public services, leading to higher costs for homeowners.

Conversely, states like Hawaii and Alabama present much lower average rates, which can be appealing for new buyers and investors. This disparity can often influence migration patterns, as people seek more favorable tax environments.

Property Tax Funds Public Services

Property tax is crucial for funding essential public services like schools and emergency services.

Understanding these averages is essential for anyone considering moving or investing in real estate, as property taxes can significantly impact long-term financial commitments.

Factors Influencing Property Tax Rates in Different States

Several factors contribute to the variation in property tax rates, including local government policies, the economy, and the overall demand for public services. States with larger populations or extensive service needs may impose higher rates to meet these demands effectively.

Real estate taxes can be a complex labyrinth, but understanding them is key to making wise investment decisions.

Additionally, economic conditions play a crucial role. For example, states with robust economies might have lower tax rates due to higher income from other sources, while economically challenged areas might rely more on property taxes.

Local policies, such as tax exemptions or incentives for certain types of properties, can also influence the rates. Understanding these nuances can help residents and investors navigate the complexities of property tax.

Analyzing the Highest Property Tax Rates in the U.S.

New Jersey consistently ranks as the state with the highest property tax rates, with average rates exceeding 2%. This high rate is often attributed to the state's reliance on property taxes for funding schools and local services, which can lead to a significant burden for homeowners.

Illinois and Connecticut also feature prominently on this list, with similarly high averages. These states often face challenges in balancing budgets, leading to higher reliance on property taxes, which can create a cycle of increasing rates over time.

Tax Rates Vary by State

Property tax rates can differ significantly across states, influencing home affordability and investment decisions.

For residents in these states, understanding the implications of high property taxes is crucial for budgeting and planning their financial futures.

Exploring the States with the Lowest Property Tax Rates

On the flip side, states like Hawaii and Alabama are known for their relatively low property tax rates, often below 1%. This can be an attractive feature for potential residents and investors looking for affordability in real estate.

These lower rates can often be attributed to different funding mechanisms for public services, such as higher sales taxes or income taxes, which alleviate the burden on property owners. Consequently, residents in these states may find a more favorable financial landscape.

Understanding why certain states maintain low rates can offer valuable insights for those considering relocating or investing in real estate, highlighting the diverse economic landscapes across the country.

The Impact of Property Tax on Homebuyers and Investors

For homebuyers, property tax rates can significantly influence affordability. A higher tax rate can increase monthly housing costs, making it essential for buyers to factor in these expenses when searching for a home.

Investors also need to consider property tax rates when evaluating potential real estate investments. Higher taxes can eat into profits, while lower rates might enhance the return on investment, affecting decisions on where to invest.

Impact on Homebuyers and Investors

Understanding property tax implications is vital for homebuyers and investors to make informed financial choices.

Ultimately, understanding the implications of property tax rates can help both buyers and investors make informed choices that align with their financial goals.

Future Trends in Property Tax Rates Across the States

As the economy evolves, so do property tax rates. Trends indicate that states may increasingly look for alternative revenue sources to alleviate the pressure on property taxes, especially in high-rate states.

Additionally, the rise of remote work and changing demographics may influence property demand, leading to shifts in tax rates over time. For instance, if more people move to lower-tax states, it could result in increased demand and potentially higher property values.

Monitoring these trends is crucial for homeowners and investors alike, as they can significantly impact property markets and tax rates in the coming years.